Patient Financing Service For Medical Aesthetics Practice Included in PLATINUM Monthly Service

Offering patient financing in a medical aesthetics practice makes high-value treatments more accessible while increasing conversion rates, revenue, and customer loyalty. Many patients want aesthetic procedures but hesitate due to upfront costs. Financing removes financial barriers, allowing patients to move forward with their treatments while ensuring the practice gets paid promptly. Below are detailed benefits with real-world examples illustrating how financing transforms both practice operations and patient experiences.

Benefits for the Practice (by offering Patient Financing App on your website)

Example 1. Increased Treatment Conversion Rates

Scenario: A patient schedules a consultation for laser skin resurfacing but hesitates due to the $3,000 upfront cost.

Benefit in Action: The practice offers a financing option of $100/month for 30 months, making the treatment more affordable.

Result: Instead of walking away, the patient books the procedure immediately, increasing the practice’s conversion rate and treatment bookings.

Real-World Application and Ideas:

- A medspa noticed that 30% of patients who inquired about CoolSculpting didn’t proceed due to cost. After implementing financing, they converted 12% more consultations into treatments.

Marketing Tip: Train front desk staff and patient coordinators to introduce financing before discussing pricing to prevent sticker shock.

Example 2. Boosted Revenue and Higher Average Order Value

Scenario: A patient visits for a $500 Botox treatment but is interested in additional services like fillers and a chemical peel.

Benefit in Action: The staff explains that financing allows them to bundle treatments for just $99/month instead of paying $1,500 upfront.

Result: The patient opts for the full facial rejuvenation package, increasing the practice’s average revenue per appointment.

Real-World Application and Ideas:

- A practice in Orlando started bundling multiple treatments with financing, leading to a 16% increase in treatment package sales.

- Patients who initially booked lip fillers ($390) upgraded to full facial contouring ($2,200) when given the financing option.

Upselling Tip: Promote combo treatments like “Glow & Lift Package – Just $99/Month” to encourage higher-value purchases.

3. Improved Cash Flow & Reduced Financial Risk

Scenario: A medspa performs multiple $3,000+ procedures in a single week.

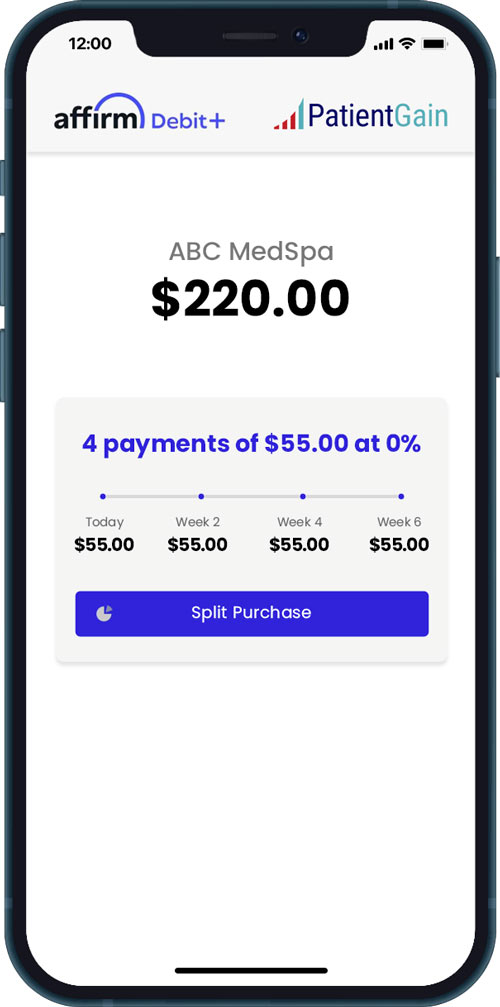

Benefit in Action: Instead of waiting for payments over time, the financing company pays the practice immediately, while the patient makes monthly payments to the lender. The lender takes the risk, not the MedSpa. Lenders have perfected their lending algorithms based on AI and are able to approve the patients while they are still on your website, like using PatientGain’s Payment App.

Result: The practice enjoys consistent cash flow, enabling staff salary payments, equipment upgrades, and advertising investments.

Real-World Application and Ideas:

- A aesthetic center using Affirm-Stripe-PatientGain App and CareCredit for financing reported a 13% revenue increase because they could take on more high-ticket procedures without financial delays.

- Practices using third-party financing eliminate collection issues and avoid spending hours chasing unpaid bills.

Cash Flow Tip: Choose a financing partner that offers upfront payments for the entire procedure ( but you as the practice has to deliver the services) so the practice doesn’t have to manage extended payment plans.

4. Enhanced Marketing Tool for Patient Acquisition

Scenario: A practice launches a Google SEO, Google PPC ads and social media ad campaign to attract new patients.

Benefit in Action: Instead of just promoting services, the ad highlights “Get Lip Fillers for Just $99/Month!”

Result: The ad generates 13% more inquiries, as more patients engage with financing offers than with high upfront costs.

Real-World Application:

- A medspa in Las Vegas ran an Google SEO, Google PPC ads and social media ad campaign with payment plan messaging, leading to a 11% increase in consultation bookings.

- Another clinic added financing options to their Google SEO, Google PPC ads and social media ad campaign, increasing click-through rates by 22%.

Marketing Strategy:

- Run seasonal financing promotions: “Holiday Glow Package – Pay Over Time!”

- Advertise limited-time 0% interest financing to drive urgency.

5. Reduced Administrative Burden & Time Savings

Scenario: A clinic used to manage in-house payment plans, leading to delayed payments and frequent collections issues.

Benefit in Action: The practice outsources patient financing to a third-party company, which handles credit approvals, collections, and billing.

Result: The staff spends less time on financial paperwork and more time on patient care, improving customer experience.

Real-World Application:

- A busy medspa in Dallas saved 10+ hours per week by switching from in-house financing to using Affirm-Stripe-PatientGain App and CherryPay.

- Practices using automated financing solutions see fewer no-shows and cancellations because patients commit financially upfront.

Efficiency Tip: Use financing integrations in your website to pre-qualify patients before consultations – This service offered by PatientGain.

Benefits for the Patients (by offering Patient Financing App on your website)

1. Increased Affordability & Reduced Financial Stress

Scenario: A patient who has lost over 46 LBS using the Semaglutide GLP-1 injections, now wants to get rid of the excessive loose skin in the tummy area, ($6,000) but can’t afford the full amount upfront.

Benefit in Action: The practice offers a financing plan at $200/month, making the treatment affordable without overwhelming financial burden.

Result: The patient proceeds with the procedure confidently, achieving their aesthetic goals without financial stress.

Real-World Application:

- Over 87% of aesthetic patients surveyed said they would prefer financing options over delaying treatment.

Patient Satisfaction Tip: Highlight “No Credit Check Financing Available” for those hesitant about eligibility. Please note that you check with your service if this is available. For example by using Affirm-Stripe-PatientGain App , Affirm uses its own credit rating risk and soft credit check, without checking your credit. Affirm performs a soft credit check when you apply for financing, but it doesn’t affect your credit score. Affirm may also perform additional soft checks if you apply for more loans. Affirm reports some loans and repayment activity to credit bureaus in the United States, including Experian, Equifax, and TransUnion.

2. Flexible Payment Options for Custom Treatment Plans

Scenario: A patient wants four laser treatments ($1,600 total) but prefers small monthly payments.

Benefit in Action: The practice offers 12-month financing at $133/month, allowing the patient to complete the full treatment plan.

Result: The patient achieves optimal results without having to delay or space out treatments.

Real-World Application:

- A medspa in Pramus NJ increased repeat visits by 21% by offering treatment series financing.

Treatment Plan Tip: Promote monthly payment options on consultation forms to encourage full-treatment bookings.

3. Greater Access to Premium Treatments

Scenario: A patient thought a full facial rejuvenation ($4,000) was unattainable.

Benefit in Action: Financing enables them to pay $199/month, making the treatment plan accessible.

Result: The patient books multiple treatments at once, achieving the best outcome.

Upsell Tip: Offer tiered financing plans to encourage premium package sales.

Popular Patient Financing Providers for Medical Aesthetics

CareCredit – 0% interest short-term plans for medical aesthetics & elective procedures.

Cherry – Soft credit checks and flexible financing for medspa treatments.

PatientGain Affirm-Stripe-PatientGain App – High approval rates for cosmetic procedures.

LendingUSA – Instant pre-qualification for aesthetic services.

PatientFi – Customized payment plans for Botox, fillers, laser treatments.

Final Thoughts: How to Implement Financing Successfully

✔ Partner with a financing provider that offers seamless integration.

✔ Train staff to introduce financing early to prevent price objections.

✔ Promote financing in ads, social media, and in-office materials.

✔ Create limited-time financing specials to boost patient bookings.